Net leverage ratio

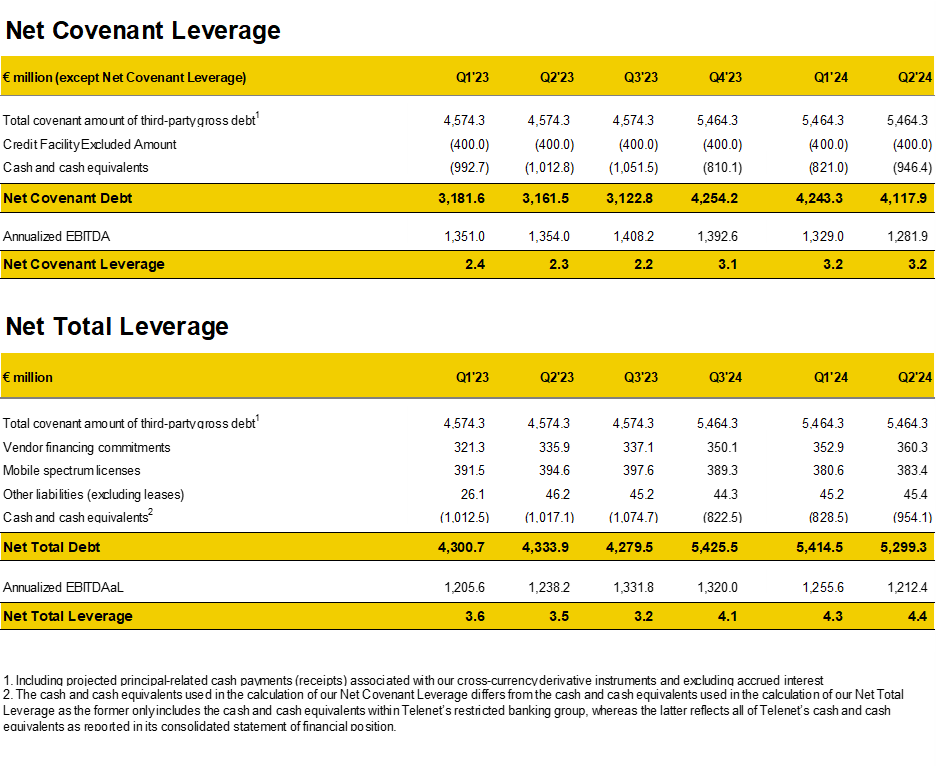

At June 30, 2024, and subject to the completion of our corresponding compliance reporting requirements, the ratios of Net Total Leverage and Net Covenant Leverage were 4.4x and 3.2x, respectively, compared to 4.3x and 3.2x at March 31, 2024. The modest QoQ increase in Net Total Leverage was driven by a lower annualized Adjusted EBITDAaL, which more than offset the robust increase in our cash balance in the quarter.

Net Covenant Leverage remains significantly below the springing maintenance covenant of 6.0x and the incurrence test of 4.5x net senior leverage. The maintenance covenant is only triggered in the event we draw 40% or more of our revolving credit facilities. At June 30, 2024, our revolving credit facilities were fully undrawn.

For additional information, we refer to our Q2 2024 earnings release.